The utility of looking elsewhere for dividends

Utilities are often viewed as a necessary cornerstone of any European equity income portfolio: be they the regulated utilities that may offer visible asset growth and inflation protection while paying sizeable dividends, or the more commodity exposed companies that can capture the ‘upside’ of energy prices that may offer the prospect of exponential dividend growth. That said, to what extent are the drivers of the sector within the control of the companies or easily forecastable by dividend investors? Most importantly, do the business models and the structure of the markets they operate in lend themselves to creating shareholder value versus paying a dividend in return for the risk one takes by investing in the sector and hoping for the best?

Blowing hot and cold

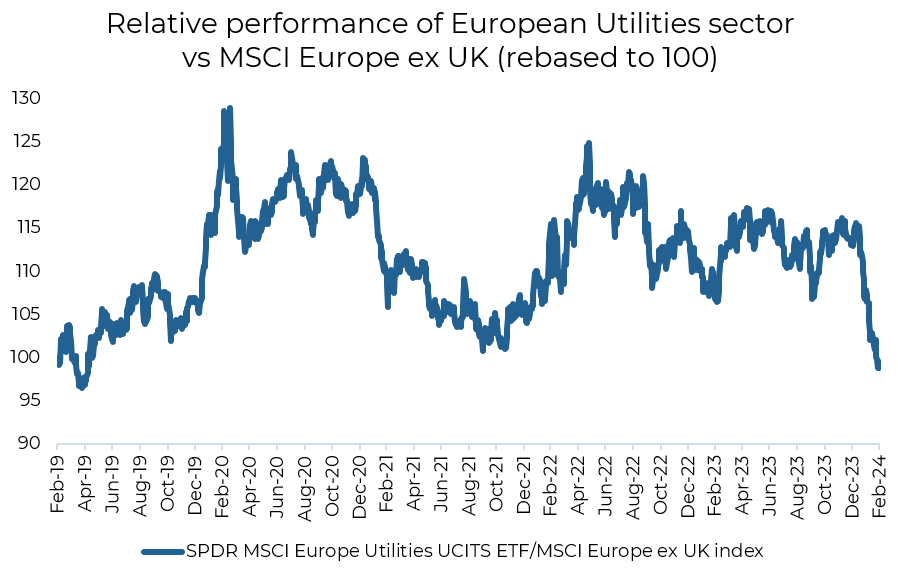

Over the two years to the end of 2023, the Utilities sector in Europe had perhaps performed better than some would have expected given the pace of interest rate rises witnessed over that period. Traditionally seen as a sector with its fair share of ‘bond proxies’ and leveraged companies, bond yields do matter: pushing up the cost of doing business, debt financing (on which the sector relies) and capex. However, the revenue and profit windfalls of the energy crisis and surge in prices caused by Russia’s invasion of Ukraine, as well as the desperate attempts by governments and regulators to keep the lights on in Europe allowed utilities to perhaps fare better than they would otherwise have done. In addition, the weaker European economy and growth added to the sector’s ‘defensive’ lustre.

However, the sector’s performance year-to-date and over the last five years, for illustrative purposes, highlight why it remains problematic for long-term dividend investors like us; one where our investment philosophy and process leave us with few well-grounded and justifiable reasons to invest.

Source: Bloomberg, March 2024

Plus ça change

First and foremost, the main drivers of the revenue and profits of utility companies are largely determined by factors outside of managements’ control and are subject to the vagaries of numerous external factors from (geo)politics and regulation to interest rates through commodity prices.

Political interference in the sector is always a risk. Recall the ‘Robin Hood taxes’ in Spain and Italy post the Global Financial Crisis or the ban on paying dividends in France during the COVID-19 pandemic as utilities were told to show solidarity with the masses. In some respects, the sector benefited from politics in 2022 as Europe scrambled to protect the consumer from the energy price spike, the German utility Uniper was rescued, and an understanding appeared to be reached with the sector that it could harvest the windfall profits caused by Europe’s over reliance on Russian Gas. However, it will be no surprise if governments find a way of clawing some of this windfall back via higher taxes or a less favourable regulatory environment.

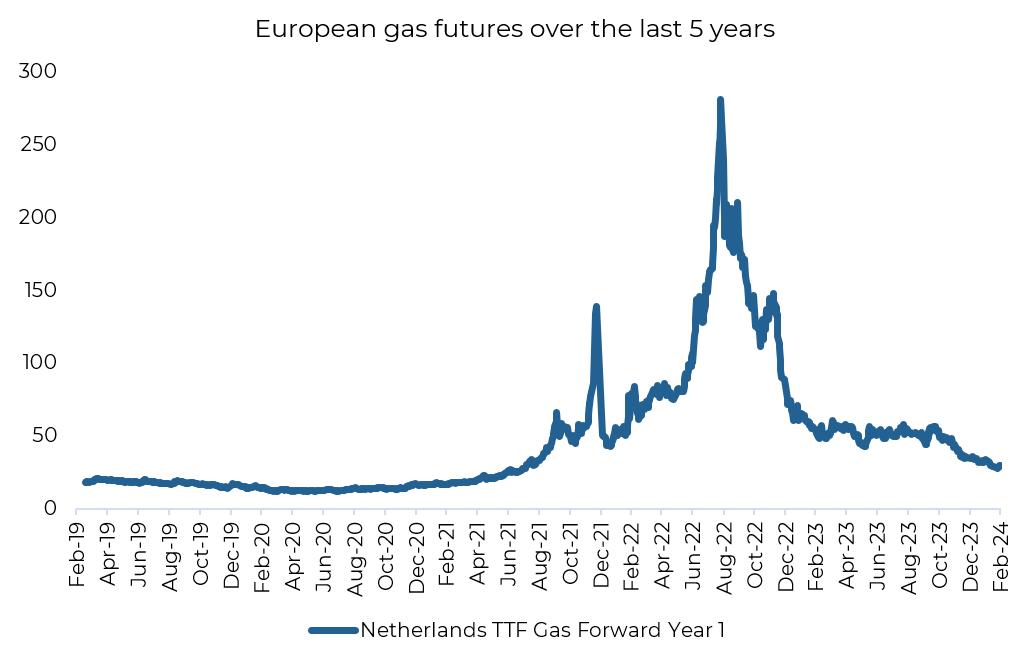

The sector’s dependence on energy prices and ultimate lack of pricing power can make for a volatile ride. As the chart below shows, one year forward gas prices are now below where they were before the Russian invasion of Ukraine.

Source: Bloomberg, March 2024

Rather than attempting to model what energy prices might do in the aftermath of such an event, investors seeking reliable dividend payments would be better off looking towards companies less subject to factors so far out of their control.

Feel the yield?

A common expression in dividend investing – perhaps too common – is, ‘Well, at least you get paid to wait’. But what, when it comes to the utilities sector, are investors paid? While one can observe that, currently, the dividend yield available from the sector looks optically attractive at over 5%, absolute levels of yield should always be regarded with scepticism. Perhaps they reflect the market’s concerns around the sustainability of the dividend itself or even the higher underlying risk of a business given its lack of control of the variables that allow it to make money.

The power of dividend investing comes from identifying quality businesses that have, among other things, the right market position, product, or franchise to generate a return on capital that allows them both to pay attractive and growing dividends while retaining capital to reinvest effectively to drive and grow intrinsic value. The power of compounding!

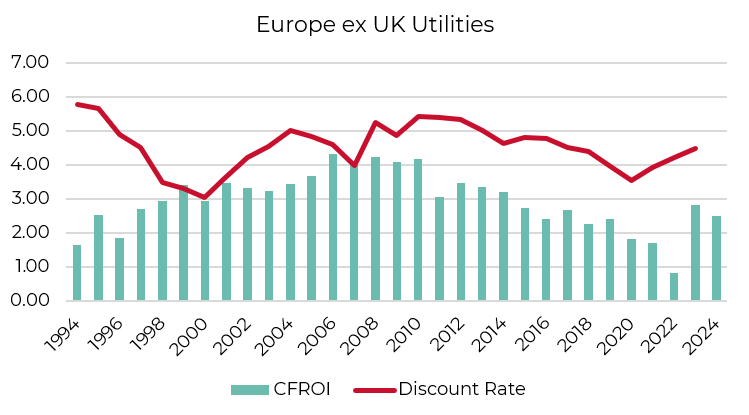

The utility of investing elsewhere

Now, for more short-term investors or ‘dividend clippers’, the sector may look ripe for some mean reversion post the recent period of poor relative and absolute performance. However, we take a different approach to dividend investing. Rather than screening for yield, we first look for persistent cash returns on capital as the basis for sustainable and growing dividends. This means we will never be tempted just by the optically high yields on offer from utilities, and that utilities tend to fall well below our return on capital threshold. In aggregate, the sector has struggled to create or been allowed to create returns over its cost of capital (as measured by Cash Flow Return on Investment (CFROI)) over the last 30 years.

Source: CS Holt, February 2024

This lack of ‘quality’ in the sector makes us wary when assessing the foundations and sustainability of any dividend being paid. Coupled with the external factors that utilities are subject to we believe we are better off seeking the value creation and dividends on offer across other sectors in Europe.

Risk: The Guinness European Equity Income Fund and WS Guinness European Equity Income Fund are equity funds. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, and you may not get back the amount originally invested. Further details on the risk factors are included in the Funds’ documentation, available on our website (guinnessgi.com/literature).

The Funds are actively managed with the MSCI Europe ex UK Index used as a comparator benchmark only. The Funds will invest primarily in European Ex UK companies which pay dividends.

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.